UAE’s Mubadala to join $10 billion Singapore data center deal

Abu Dhabi-based Mubadala Investment Co is reportedly in discussions to join a consortium seeking to acquire Singapore-based data center operator STT GDC. Bloomberg reported that Singapore’s sovereign wealth fund GIC is also in talks to participate, with both sovereign investors potentially coming in as minority co-investors.

The report said the proposed transaction could value STT GDC at more than $10 billion, including debt. Members of the consortium are working to finalize the buyout terms, with an announcement expected this week.

Singapore Telecommunications, a member of the buying consortium, said it was in advanced discussions regarding STT GDC, adding that there was no certainty that a definitive agreement would be reached.

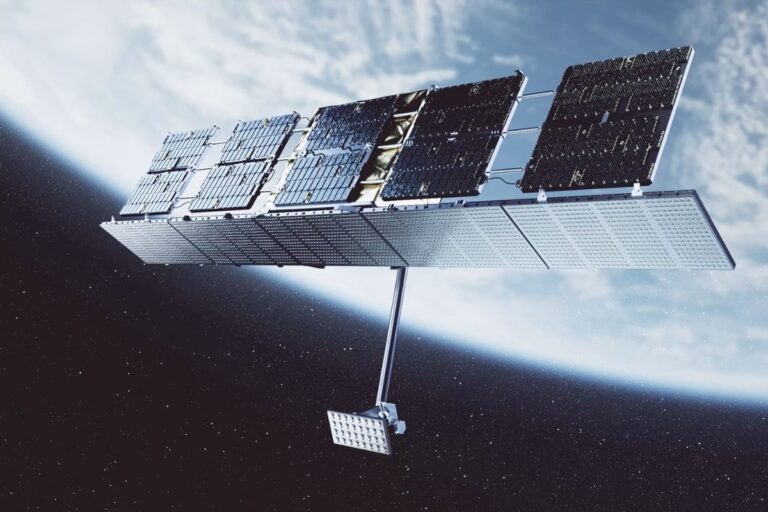

STT GDC operates more than 100 data centers across 20 markets, including India, South Korea, Japan, Malaysia, the UK, Italy, and Germany.

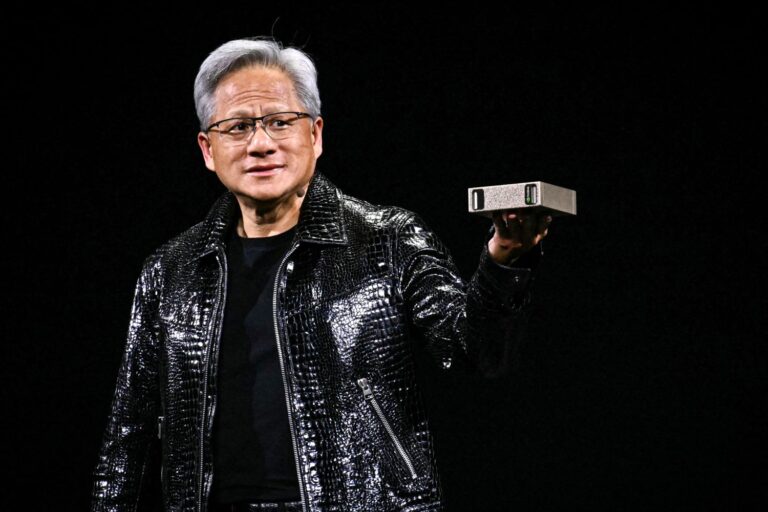

Last month, Mubadala Group CEO Khaldoon Al Mubarak said the $330 billion sovereign wealth fund was targeting opportunities in artificial intelligence and robotics, describing those sectors as key engines of industrial growth.

The United Arab Emirates has also joined Pax Silica, a US-led coalition formed last month that aims to secure cross-border infrastructure and supply chains suited to the AI era. Earlier, the UAE was selected to host the “Stargate UAE” project, which is planned to become the largest AI campus outside the United States. Stargate UAE is being developed by G42 (backed by Mubadala) and a group of international heavyweights, including Nvidia, OpenAI, Oracle, Cisco, and others.