Report: 500 AI Startups Are Now Valued at Over $1 Billion

⬤ Reports reveal that there are currently 498 AI startups valued at more than $1 billion.

⬤ Most of these companies are concentrated around San Francisco, with a combined valuation exceeding $2.7 trillion.

⬤ Dozens of new billionaires have emerged from these startups in what has been called “the fastest and largest wealth creation wave in history.”

The world of artificial intelligence is generating wealth at an unprecedented pace. According to data from CB Insights, there are currently 498 AI unicorns, which are private companies valued at $1 billion or more. Collectively, these startups are estimated to be worth around $2.7 trillion.

Interestingly, 100 of these highly successful companies were founded in 2023 or later. Expanding the scope to include AI startups valued at more than $100 million brings the total number to about 1,300.

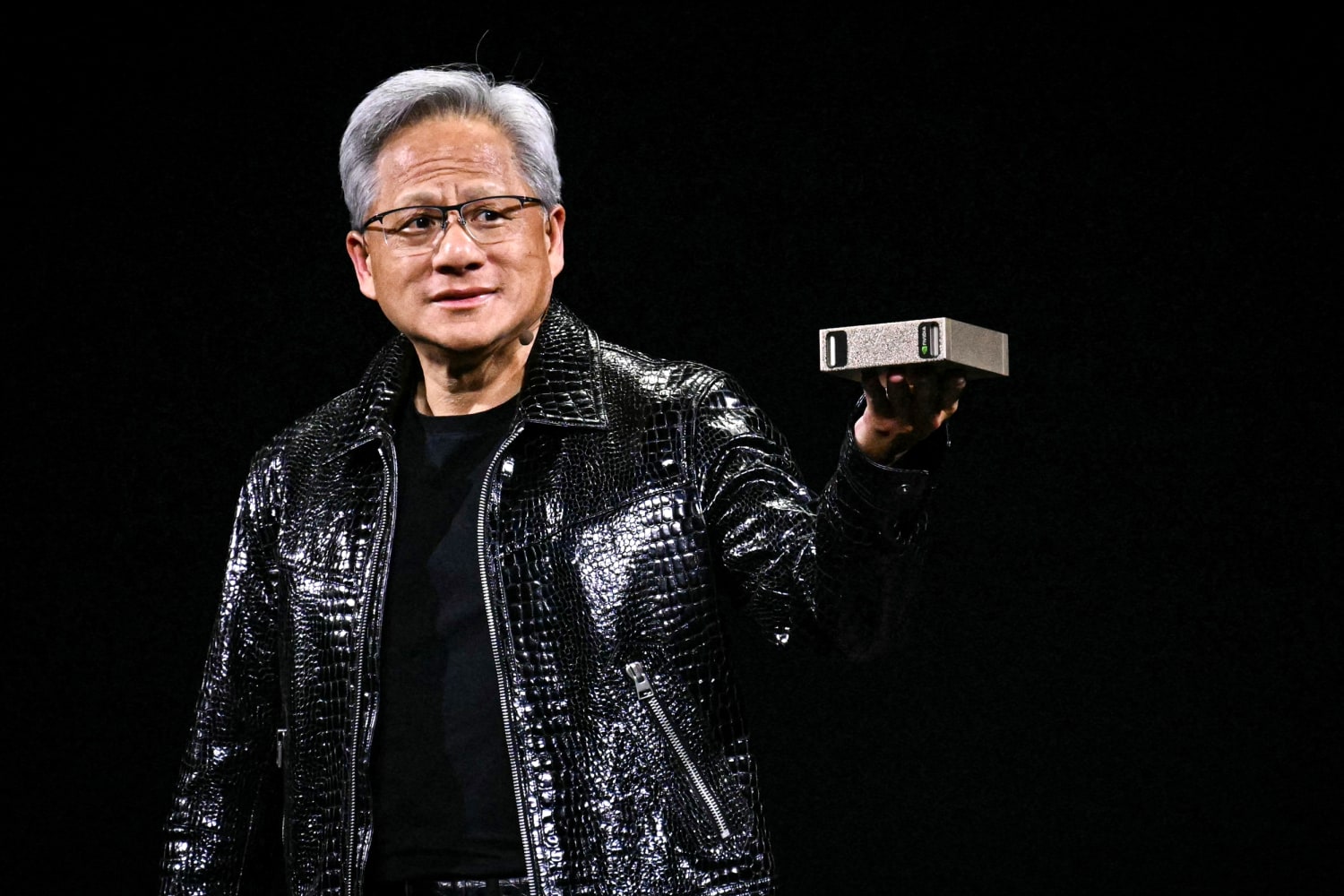

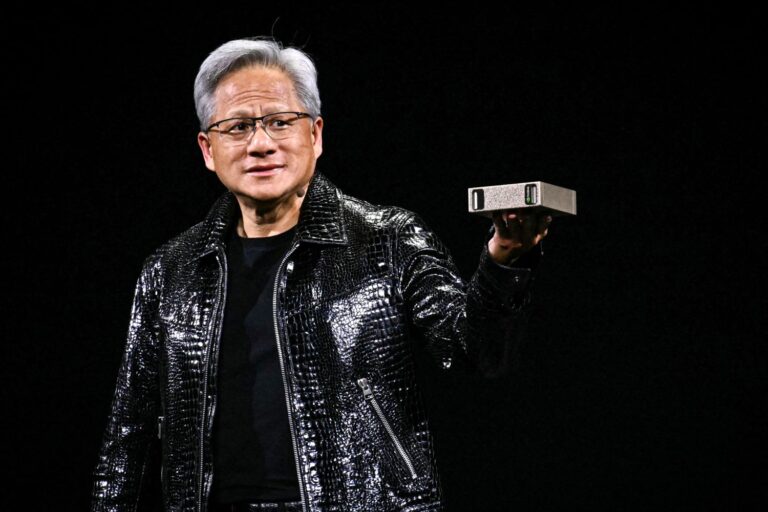

This phenomenon is quickly shaping up to be one of the most significant periods of wealth creation in modern history. Massive funding rounds this year for companies such as Anthropic, Safe Superintelligence, OpenAI, and Anysphere have generated enormous paper fortunes and pushed valuations to record highs. The effects extend beyond private markets as well, with soaring stock prices of major players like Nvidia, Meta, and Microsoft, along with infrastructure firms that support data centers, greatly increasing the wealth of founders, employees, and investors.

Andrew McAfee, principal researcher at MIT, told CNBC: “Looking back over more than a century of data, we have never seen wealth created at this scale and this speed. It is unprecedented.” The rapid rise in valuations has already produced a wave of new billionaires. Bloomberg estimated in March that four of the largest private AI firms alone created at least 15 new billionaires with a combined net worth of $38 billion. Since then, the number has only grown as more AI unicorns have joined the list.

Despite these massive valuations, analysts caution that most of these AI companies are still private, which limits investor liquidity. Their valuations could also change significantly if the broader market or technology trends shift. Many private companies that flourished during the internet boom of the late 1990s later collapsed in the early 2000s. While the comparison between the dot-com bubble and today’s AI surge is not perfect, it serves as a reminder of the risks of inflated valuations without strong financial foundations or proven products.

To improve liquidity, new secondary markets have recently emerged that allow limited trading of shares in private firms or loans secured by company equity. This trend is gaining traction among major AI companies such as OpenAI, which is reportedly in talks to sell secondary shares at a proposed valuation of $500 billion.

According to CB Insights, there have been 73 liquidity events since 2023, including mergers, acquisitions, IPOs, and large stake sales. In total, 498 AI unicorns now represent a combined value of $2.7 trillion.