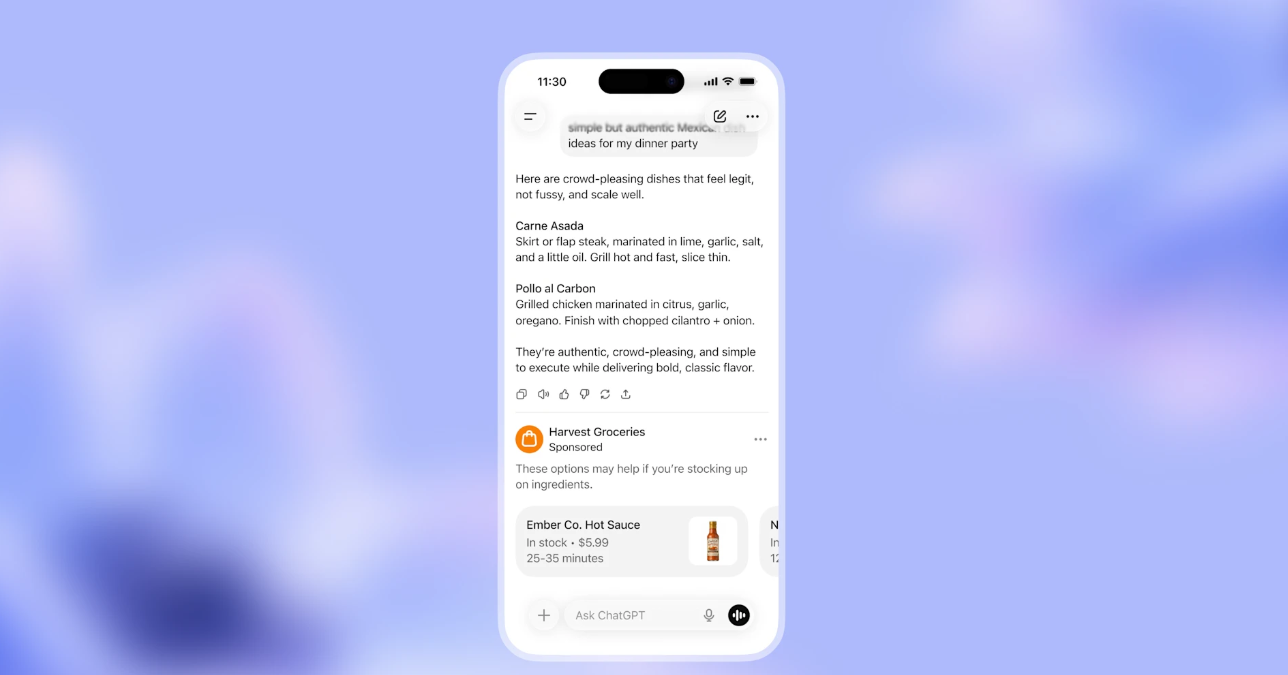

Memory shortage pushes up SSD, GPU, hard drive prices

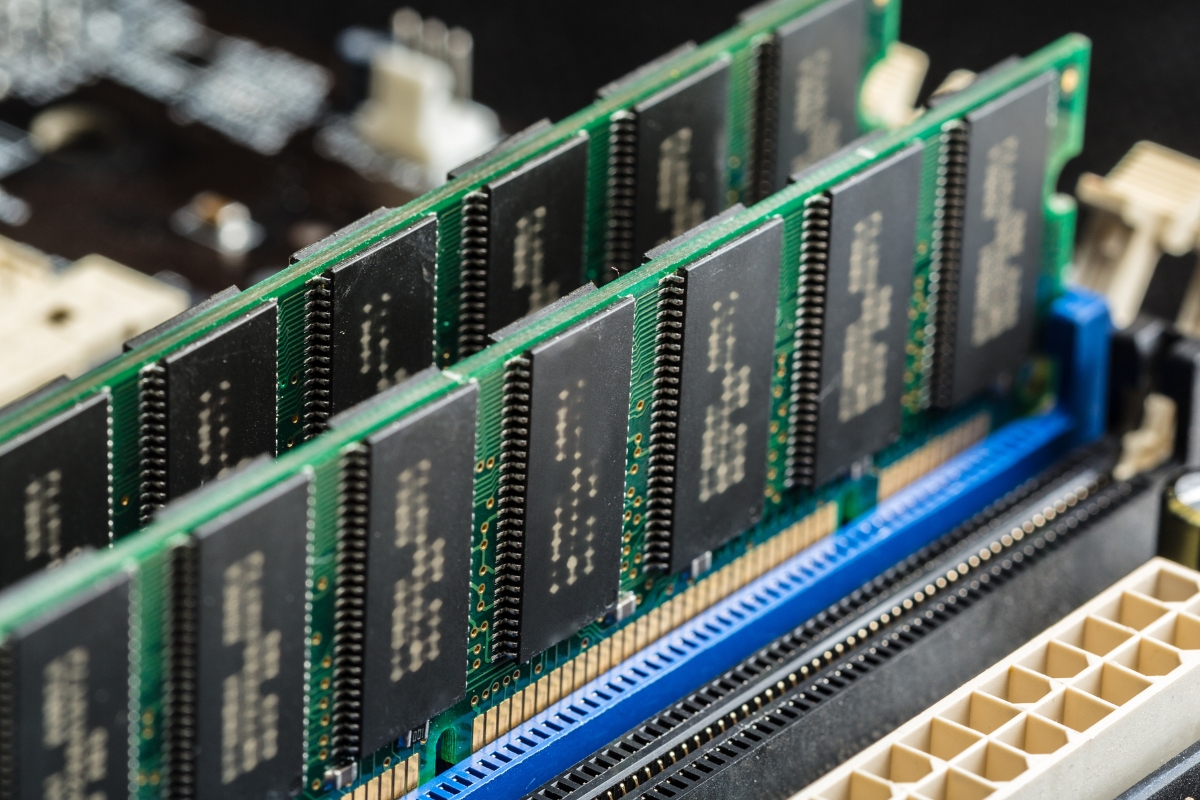

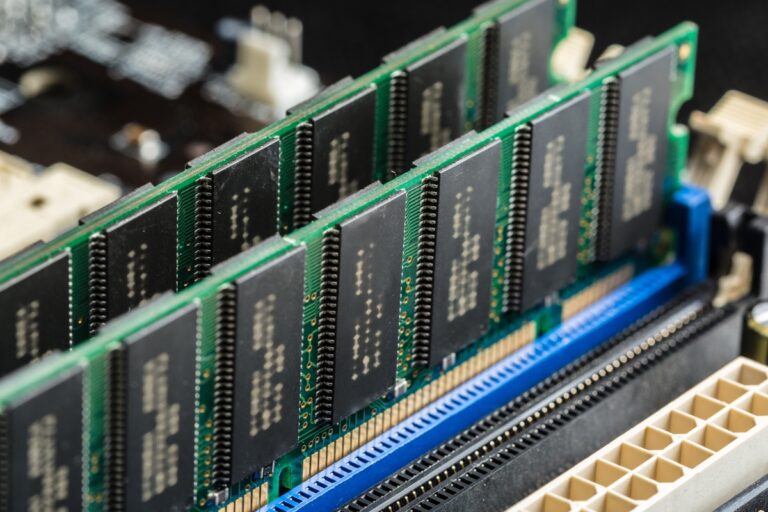

A tightening global memory market is pushing up prices across consumer hardware, as higher costs for dynamic random access memory (DRAM) and NAND flash spill over into components used in everyday PCs and laptops. Retail pricing examples cited in the report show sharp moves in solid-state drives (SSDs), graphics processing units (GPUs), and hard disk drives (HDDs), with additional signs that smartphone makers are revising production expectations.

High-capacity M.2 NVMe SSDs have seen notable pricing changes over recent weeks. A 2-terabyte (TB) Western Digital drive that had been available for about $230 last year was listed at about $370 at a major U.S. retailer, having an increase of about 60% over a short period. A 2TB Samsung 990 Evo Plus also rose from roughly $170 the previous month to about $440, according to a recent price comparison report by TrendForce. The report also noted that some 4TB drives from Silicon Power and Crucial were still listed near $350 at Amazon and Best Buy, with the caveat that prices may not hold if current supply conditions persist.

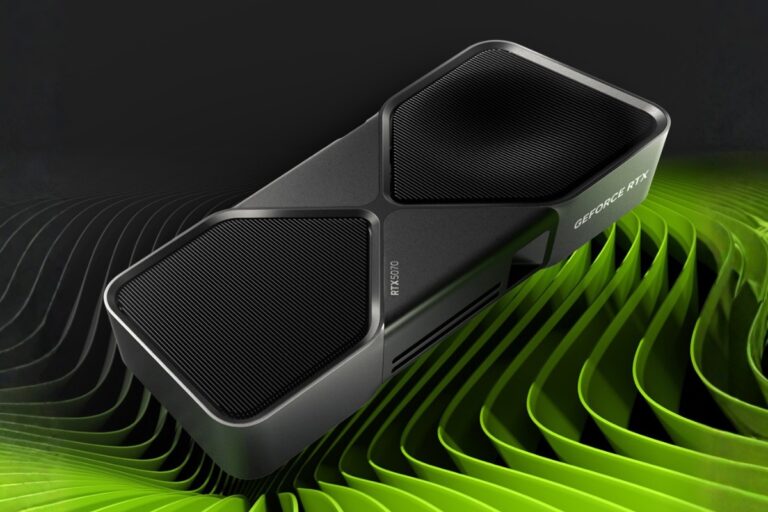

The report also highlights that GPU pricing is being affected, with multiple models selling above the manufacturer’s suggested retail price (MSRP). One example cited is the Nvidia GeForce RTX 5070 Ti, which is selling for around $1,100 through some vendors, compared with an MSRP of $749. Another example is AMD’s Radeon RX 9070 XT, listed at around $750, compared with an MSRP of $599, with other mid-range models also described as selling above official pricing.

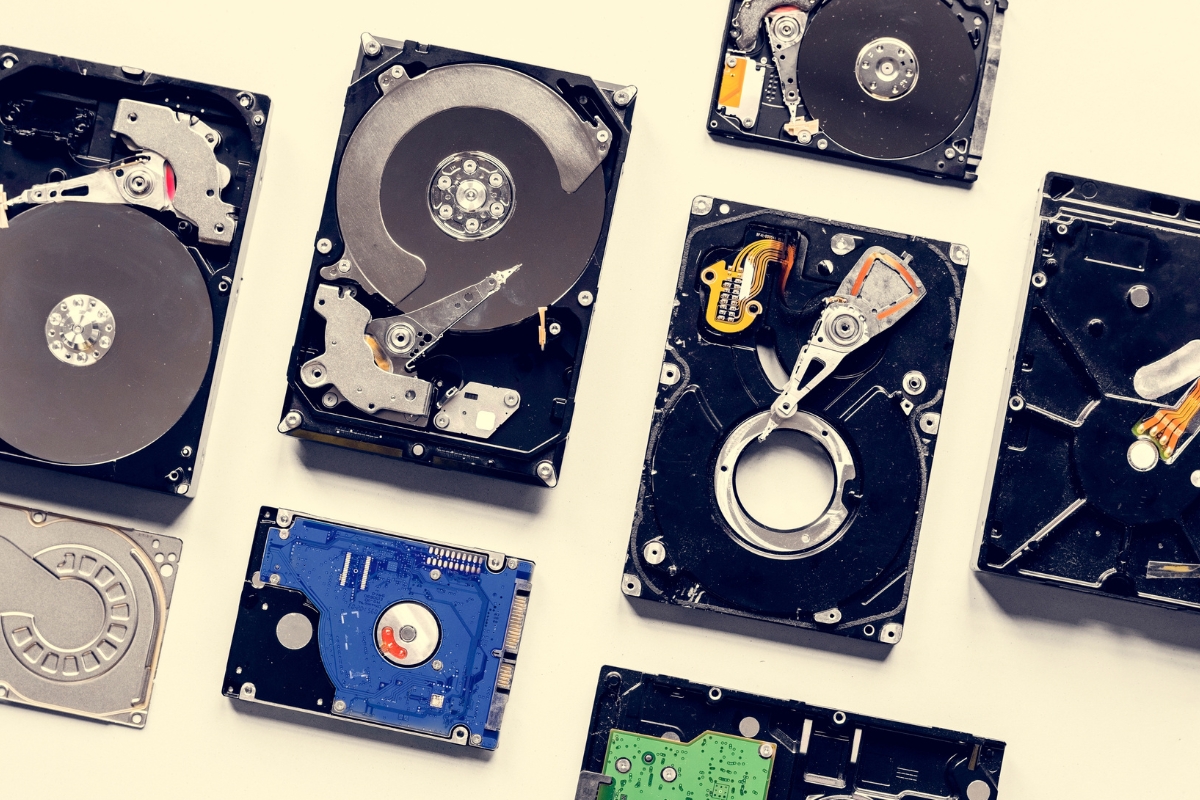

HDD pricing is also showing movement, particularly for premium and higher-capacity products. Examples cited include a 6TB Western Digital Red NAS drive rising from about $80 last year to about $160, and a 12TB Seagate IronWolf climbing from about $240 to about $270. A 16TB IronWolf also rose from about $240 to $260 over recent weeks.

The report ties the ripple effect to a broader memory shortage extending into 2026, with elevated demand from server and artificial intelligence data center buildouts, alongside supply chain constraints. TrendForce’s January 2026 pricing outlook projects conventional DRAM contract prices rising 55%–60% quarter over quarter in the first quarter of 2026, while NAND flash prices are expected to rise 33%–38% quarter over quarter. TrendForce also notes widening supply-demand gaps as cloud service providers lock in capacity.

The same pressure is being linked to smartphone supply planning. Reporting tied to Jiemian and upstream supply chain guidance indicates that some Chinese smartphone brands have cut 2026 shipment expectations, with references to reductions of around 20% for certain vendors and forecasts that global smartphone shipments could decline by about 2% this year.