Intel-made chips could make a comeback to Apple devices in 2027, report claims

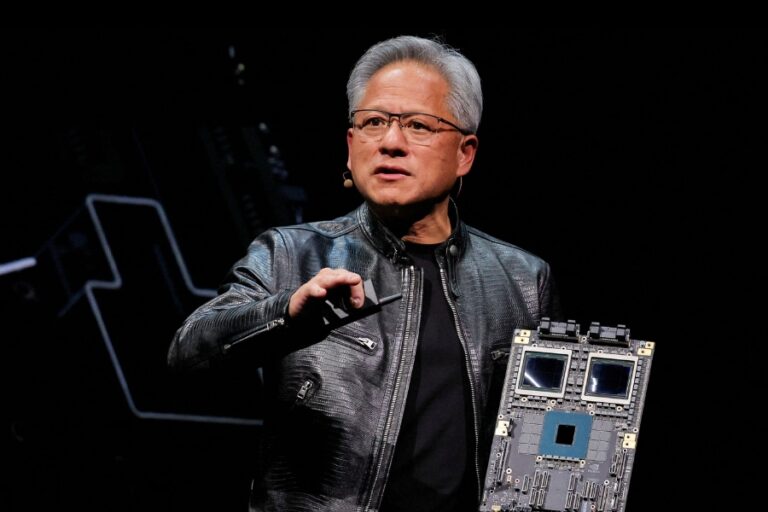

After years of separation, Intel-made chips may have a comeback to Apple devices, namely Macs and iPads, by 2027. Reports suggest that Apple and Intel are moving toward a potential foundry agreement, with Intel serving as a contract manufacturer for Apple’s M-series SoCs rather than supplying CPUs as before.

Analyst Ming-Chi Kuo outlined a possible arrangement that would position Intel as an additional advanced-node partner alongside TSMC, contingent on the progress of Intel’s 18AP process over the next 18 to 24 months.

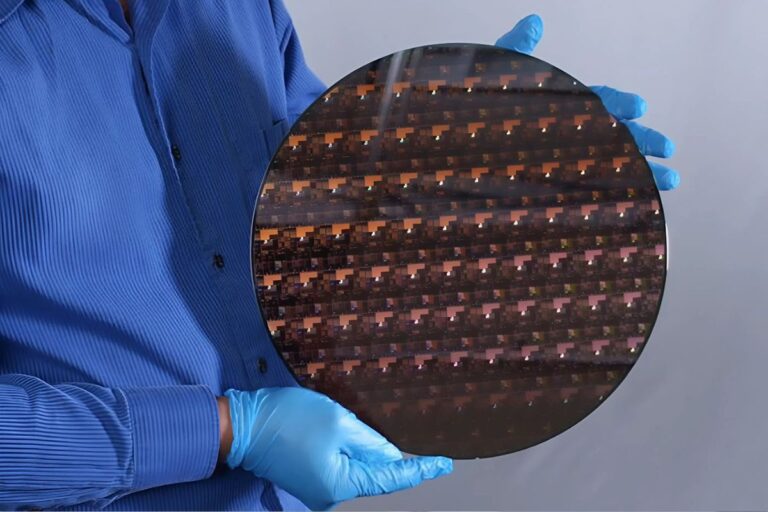

Kuo reports that Apple has already signed an NDA with Intel to access an early design kit for the 18AP node, specifically the 0.9.1 GA revision, enabling Apple’s silicon engineers to simulate and prototype designs on Intel’s upcoming process technology. Although the kit does not represent the complete manufacturing stack, it provides enough detail for architecture work and initial physical design on an entry-level M-series chip.

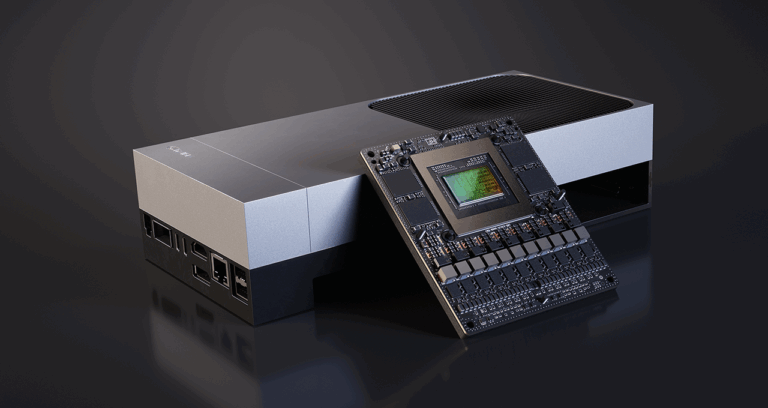

The next major step is the release of Intel’s 18AP PDK 1.0/1.1, which Apple expects during the first quarter of 2026. If Intel meets that timeline and the PDK is ready for production, Apple intends to design and ramp its next entry-level M-series processor, used in the MacBook Air and iPad Pro, on the 18AP node. High-volume manufacturing at Intel would then begin in the second or third quarter of 2027.

Kuo and other industry sources note that Apple’s internal roadmaps for M-series chips align with Intel’s broader strategy of integrating compute and memory more closely within a single package, echoing the design approach of Intel’s Lunar Lake platform.

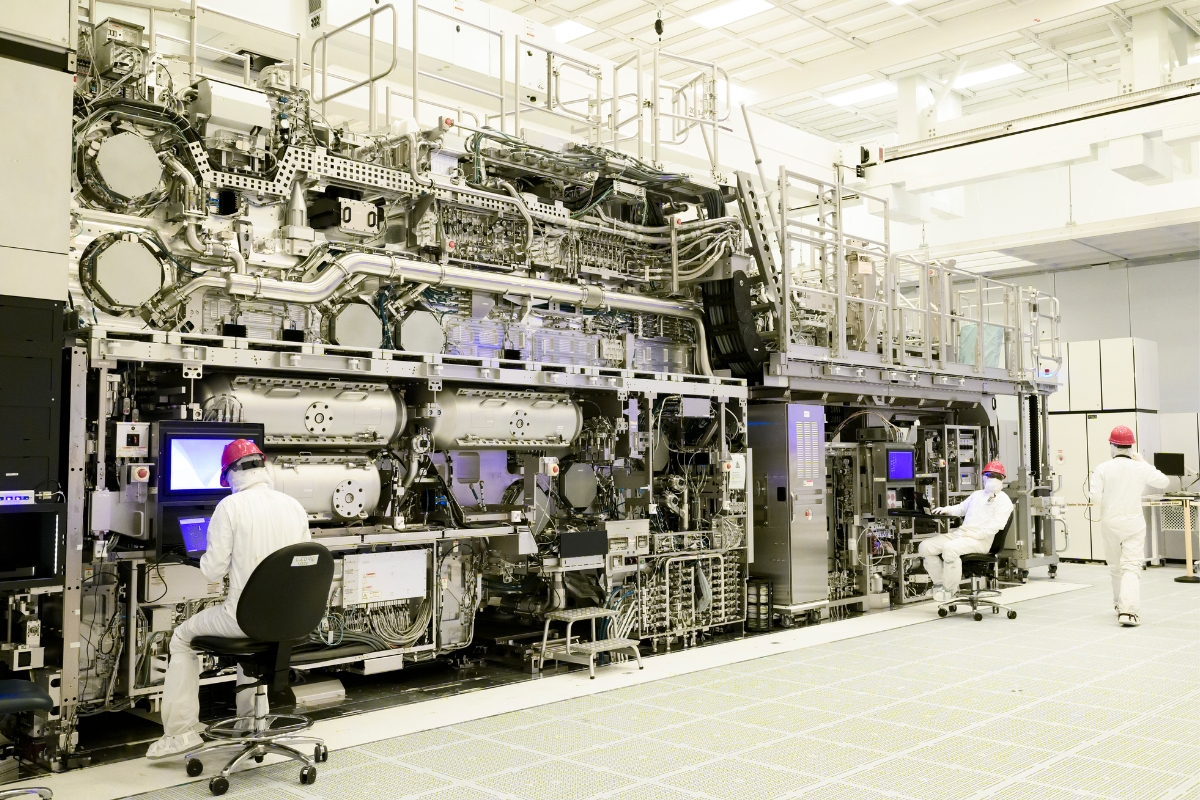

According to experts, any final agreement between Apple and Intel will depend on Intel’s technical readiness and the economics of its manufacturing processes. Executives recently stated that yields on the 18A node are improving by around 7% each month as Panther Lake CPUs approach mass production.

Kuo describes the potential partnership as a reflection of Apple’s goal to reduce reliance on a single advanced-node supplier, TSMC, while also reinforcing the company’s commitment to U.S.-based semiconductor production in the current geopolitical climate.

For Intel, securing Apple as a major 18AP customer would serve as a key indicator that its foundry resurgence is gaining momentum after years of delays and missteps. Intel has told investors it intends for its foundry business to reach break-even by 2027, and attracting large-volume, cutting-edge SoC orders from top-tier designers is central to that objective.