In a Surprise Move, Nvidia Invests $5 Billion in Rival Intel

⬤ Nvidia will become one of Intel’s largest investors with a five-billion-dollar commitment.

⬤ The deal will enable the production of high-performance servers powered by Intel processors and Nvidia AI chips.

⬤ Analysts expect deeper collaboration in the future, potentially involving Nvidia chips being manufactured in Intel’s factories.

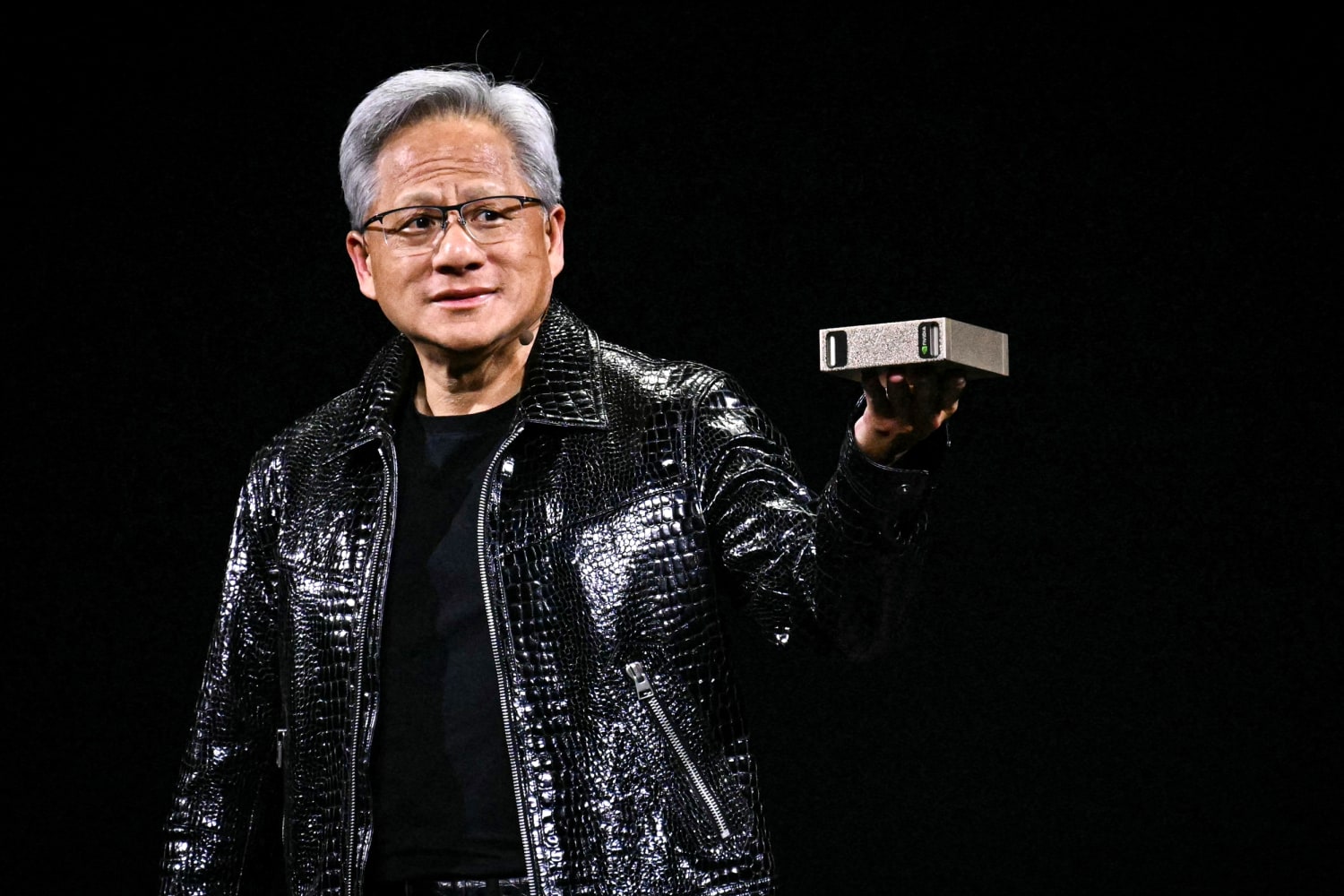

Nvidia announced on Thursday that it will invest five billion dollars in Intel, marking a significant show of confidence in the American chipmaker, which has faced major challenges in recent years. The news came as a surprise to many, given that the two companies are direct competitors in several key markets.

According to reports, the agreement also includes a plan for joint development of chips for personal computers and data centers. The collaboration could pose a potential threat to Taiwan’s TSMC, which currently manufactures Nvidia’s flagship processors. Analysts suggest that Nvidia may eventually shift part of its manufacturing to Intel’s facilities.

The announcement was met with an immediate positive reaction on Wall Street. Intel shares jumped by roughly 12 percent, while Nvidia’s stock gained around 2 percent. With this deal, Nvidia becomes one of Intel’s largest shareholders, following Intel’s earlier sale of nearly 10 percent of its equity to the U.S. government in an unusual transaction.

For Intel, Nvidia’s investment offers a new lifeline after years of transformation efforts. The company, long considered the foundation of Silicon Valley itself, has spent billions trying to regain its leadership in chip manufacturing. Under the guidance of its new CEO, Lip-Bu Tan, Intel has shifted toward a more efficiency-driven model that ties production more closely to confirmed demand rather than speculative large-scale investments.

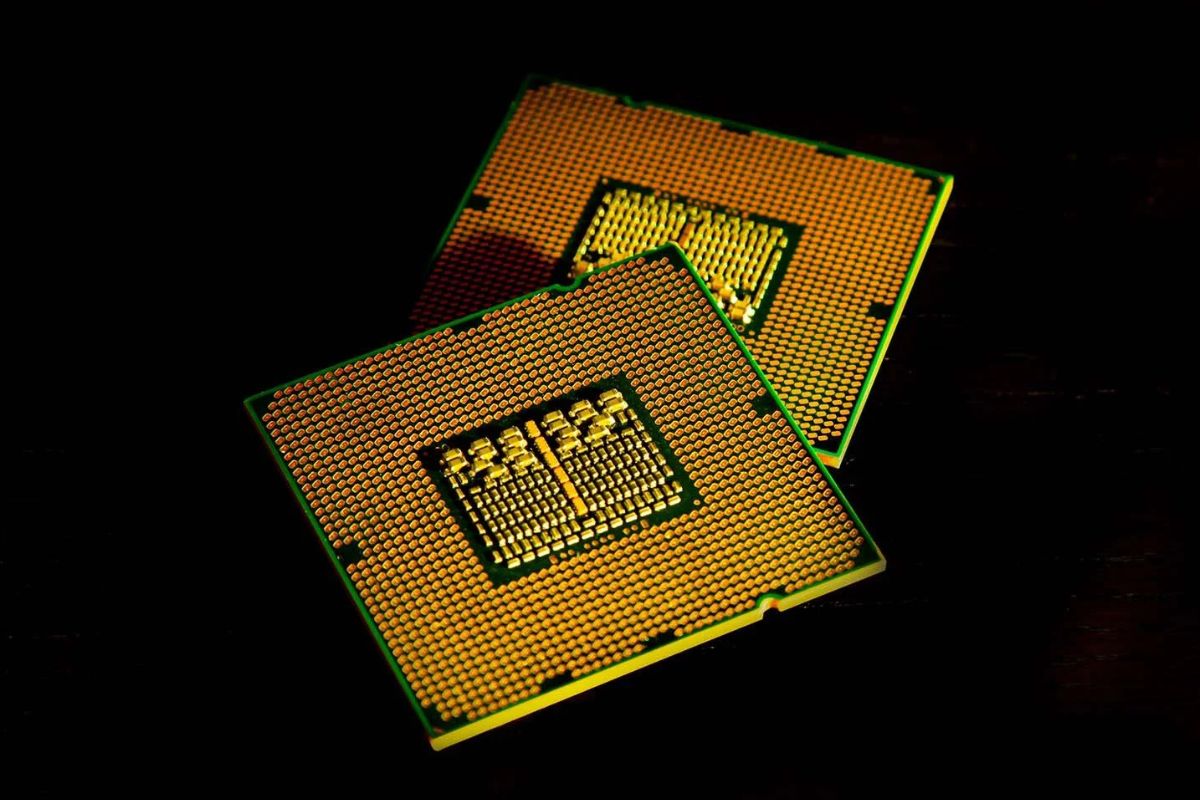

At this stage, the agreement does not include using Intel’s contract manufacturing division to produce Nvidia chips. While Intel’s foundry business needs high-profile clients such as Nvidia, Apple, or Qualcomm, significant research and development work remains before Intel can match the manufacturing capabilities of Taiwan’s TSMC or South Korea’s Samsung.

The deal further strengthens Intel’s financial position. It follows recent capital injections including a two-billion-dollar investment from SoftBank and 5.7 billion dollars in funding from the U.S. government. With these resources, Intel appears to be on firmer financial footing and better positioned to invest in key technology developments, particularly its upcoming 14A manufacturing process.

Under the terms of the agreement, Intel plans to design custom processors for data centers that Nvidia will integrate with its own AI chips. Nvidia’s proprietary technology will allow the chips from both companies to communicate at much higher speeds, a crucial capability in AI computing where multiple processors must work together seamlessly to handle massive data workloads.

These jointly developed processors could present a formidable challenge to other industry players, especially AMD, which is developing its own AI-focused server chips, and Broadcom, whose interconnect technologies already support companies like Google in creating specialized AI hardware.