AI reshapes personal computers as data centers dominate Consumer Electronics Show 2026

Artificial intelligence (AI) data centers were a major theme at the Consumer Electronics Show 2026 (CES 2026) in Las Vegas, with large-scale cloud infrastructure and server-class chips featured prominently in product roadmaps. NVIDIA’s CES announcements included the Rubin platform for next-generation AI systems, underscoring ongoing investment in data center compute.

At the same time, the personal computer (PC) market is facing multiple shifts. Competition has increased from Arm-based designs, adding pressure to the traditional Intel-centered ecosystem. Another driver is the end of support for Windows 10, which Microsoft set for Oct. 14, 2025, a change that typically accelerates hardware refresh cycles as users and organizations move to supported operating systems.

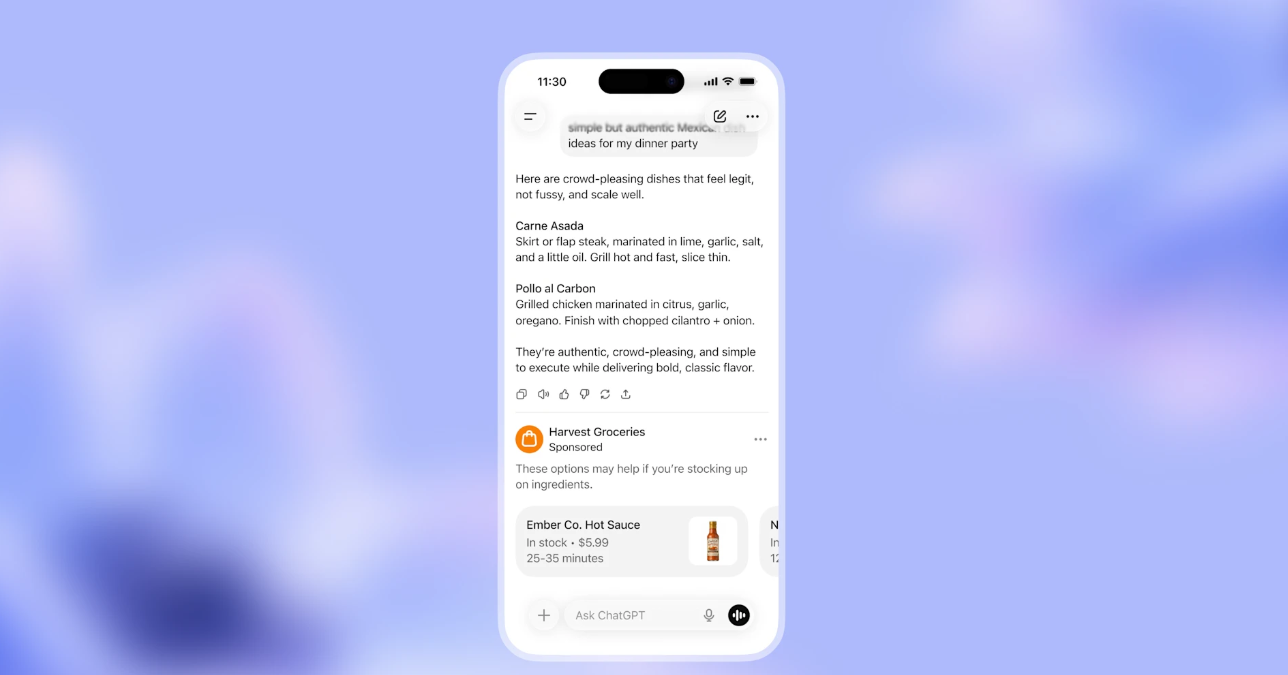

The report also describes a broader push to position PCs as an on-device front end for AI. That trend is tied to wider interest in running AI workloads closer to the user, rather than relying only on remote data centers. It also references the expected spread of smaller language models (SLMs), which are designed to deliver useful capabilities with lower compute requirements than large, cloud-scale models, making them more feasible on user devices. This shift has been linked to growing focus on neural processing units (NPUs) and other local accelerators built into new “AI PC” designs.

On the chip side, Intel used CES 2026 to introduce Intel Core Ultra Series 3 processors, describing them as the first AI PC platform built on Intel 18A process technology, with the launch positioned as part of its broader manufacturing and competitiveness roadmap.

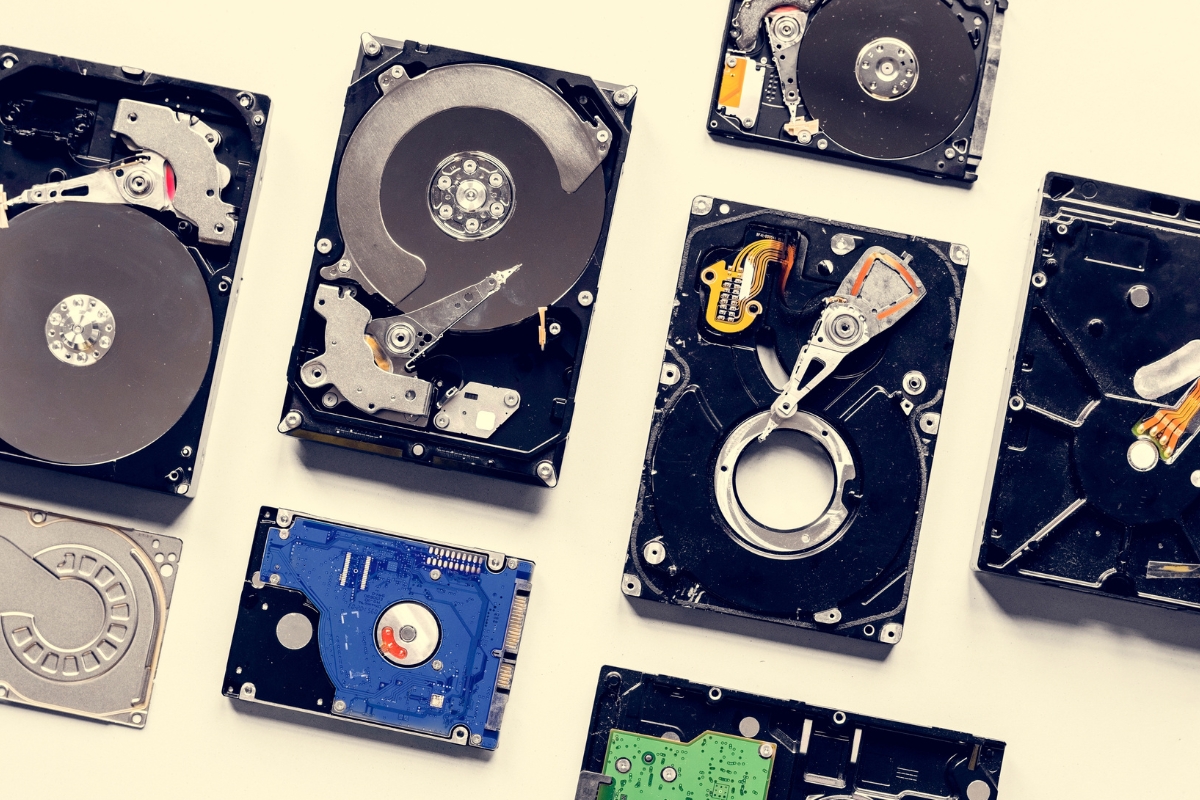

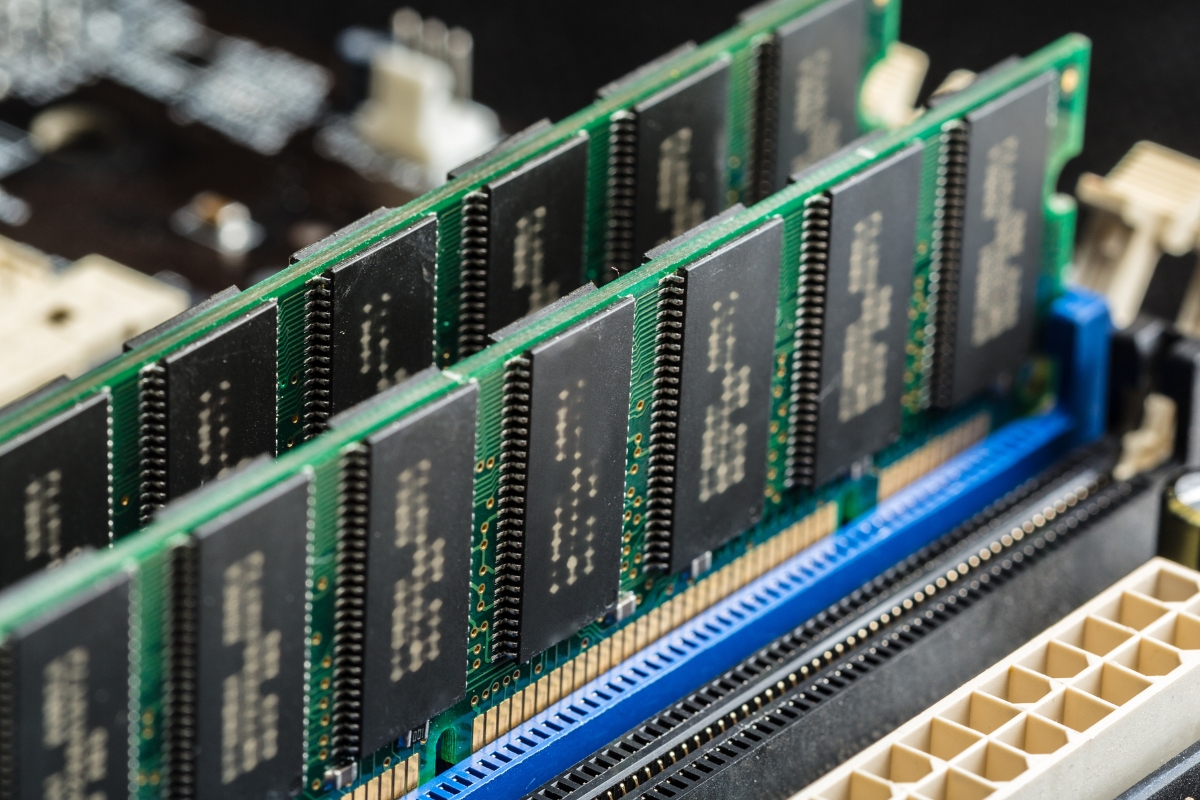

The same report points to supply chain constraints tied to AI infrastructure demand, especially for high bandwidth memory (HBM) and other memory components. International Data Corporation (IDC) described a global memory shortage environment for 2026, with rising dynamic random access memory (DRAM) and NAND storage costs and limited component availability affecting device makers.

IDC also outlined downside scenarios for 2026 PC shipments tied to memory availability and pricing, including the possibility of a steeper decline if shortages persist. Coverage of IDC’s projections has referenced a potential drop of up to 9% under the most pessimistic scenario, alongside weaker smartphone shipment expectations.