If confirmed in final results, the operating profit figure would exceed Samsung’s previous quarterly record of 17.6 trillion won set in the third quarter of 2018.

The guidance came as memory suppliers prioritized higher-margin products used in AI servers, tightening supply for other segments. Market tracking by Counterpoint Research projected memory prices rose 40% to 50% in the fourth quarter of 2025 and forecast another 40% to 50% increase in the first quarter of 2026, followed by about 20% growth in the second quarter.

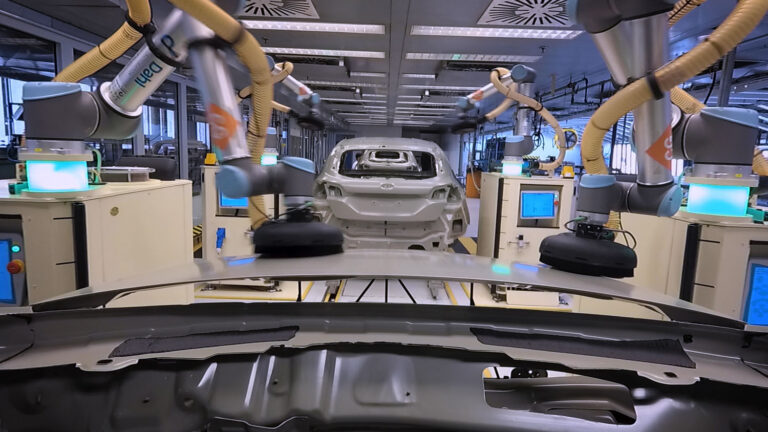

Samsung’s update also reflected an industry shift where demand for advanced memory is pulling capacity toward data centers. High-bandwidth memory (HBM), a type of memory designed to deliver very high data throughput, is widely used in AI accelerator systems. As suppliers focus on these higher-demand products, availability for memory used in personal computers and smartphones can tighten.

Samsung said it will release detailed, audited results and hold its earnings call later this month.