A $55 Billion Deal: Saudi-Backed Consortium to Acquire Gaming Giant EA

In an unexpected turn of events, video game powerhouse Electronic Arts (EA) is set to go private through a Saudi-backed acquisition involving a group of investors, including a firm led by Jared Kushner, Donald Trump’s son-in-law, and the private equity company Silver Lake. The deal values EA at 55 billion dollars, making it the largest leveraged buyout in history.

According to a statement released Monday, the agreement values EA shares at 210 dollars each, representing a 25% premium over the company’s closing price last Thursday. The stock quickly climbed after reports of the possible deal surfaced on Friday.

Based in Redwood City, California, EA owns one of the richest content libraries in the video game industry. It is the publisher behind the EA Sports FC series, previously known as FIFA, as well as other blockbuster franchises such as Need for Speed, Battlefield, and many more. Andrew Wilson, the company’s long-time chief executive officer, will remain in his position to lead EA as a private entity once the transaction is completed, which is expected during the first half of 2027.

The acquisition will be financed through 36 billion dollars in equity contributed by the consortium of buyers, including the Saudi Public Investment Fund (PIF) converting its existing 9.9 percent stake in EA, in addition to a 20 billion dollar loan led by JPMorgan.

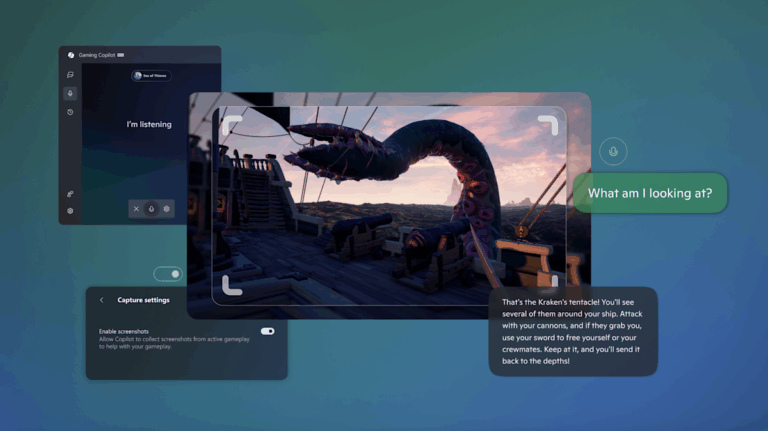

The deal represents a major wager on the power of artificial intelligence to reduce EA’s operating costs, potentially allowing the new owners to manage a much larger debt burden than the company has ever carried before.

AI technologies are already being widely used in Silicon Valley to accelerate software development. In the gaming sector, they are being applied to replace voice actors, generate backgrounds and assets, and automate testing to eliminate bugs before release. These uses have drawn criticism from both developers and players who fear a loss of creative authenticity and employment opportunities.

Still, analysts believe AI will soon transform gaming in deeper ways, enabling more lifelike and responsive characters and storylines that adapt dynamically to each player’s preferences.

Jared Kushner played a pivotal role in finalizing the deal. According to the Financial Times, Kushner and Silver Lake Co-CEO Egon Durban began exploring the acquisition earlier this year. Kushner reportedly convinced Saudi Arabia’s PIF to participate despite the fund’s recent efforts to scale back private investments.

The PIF plans to deploy up to 70 billion dollars annually from the kingdom’s oil wealth into technology, real estate, and other strategic sectors. It has long been one of EA’s largest shareholders and holds stakes in major gaming companies such as Nintendo and Take-Two Interactive.

In 2021, Saudi Crown Prince Mohammed bin Salman established Savvy Games Group, a PIF subsidiary with a capital base of 38 billion dollars. The group has already acquired several popular mobile titles, including Monopoly Go and Pokémon Go, and is now pursuing new deals in China, according to recent reporting by the Financial Times.