2025 Year in Review: Deals & Acquisitions

The AI boom of 2025 has been defined not only by rapid technical progress but by an unprecedented flow of capital reshaping the technology landscape. Record-breaking investments, sky-high valuations, and aggressive talent acquisitions have turned artificial intelligence into one of the most competitive and closely scrutinized markets in recent history.

Yet beneath the headlines, questions are emerging about how sustainable this growth truly is. From circular investment structures and massive long-term infrastructure commitments to companies paying extraordinary sums for top talent, the year’s biggest deals reveal an ecosystem fueling itself at an astonishing pace, while testing the limits of traditional financial logic and risk assessment.

Investment Going in Circles

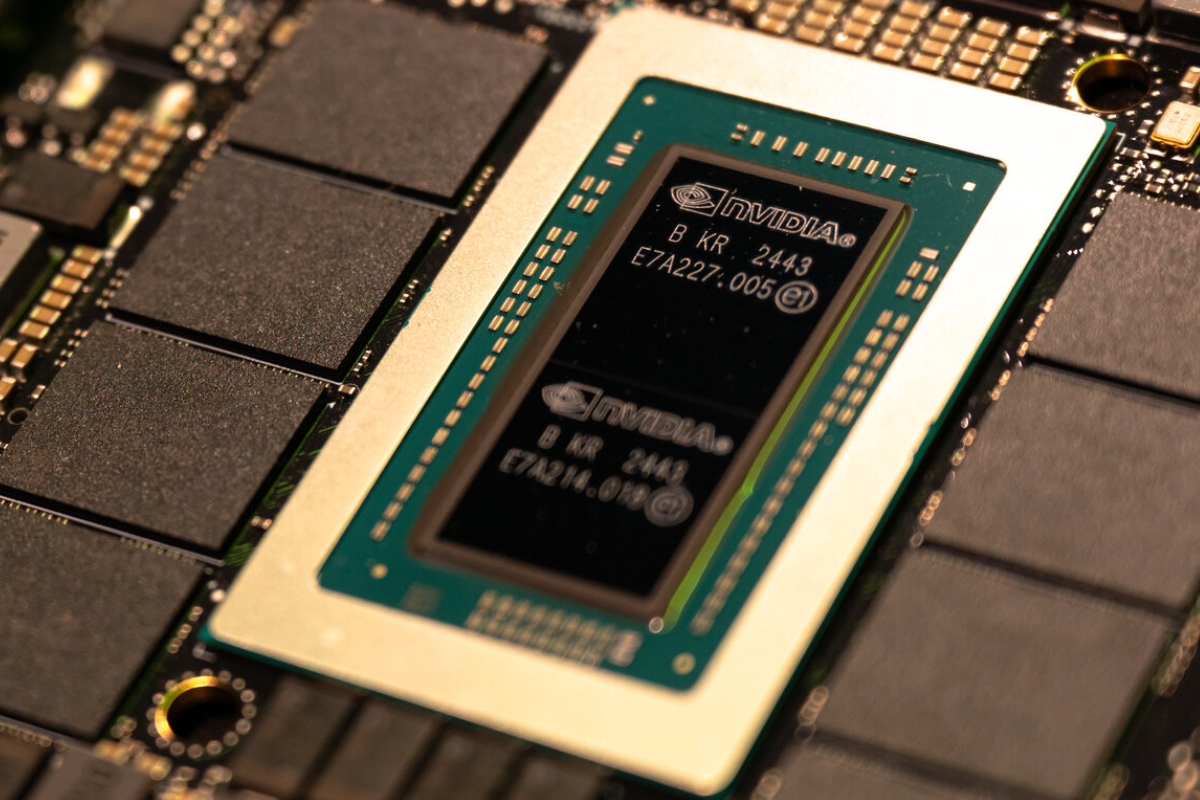

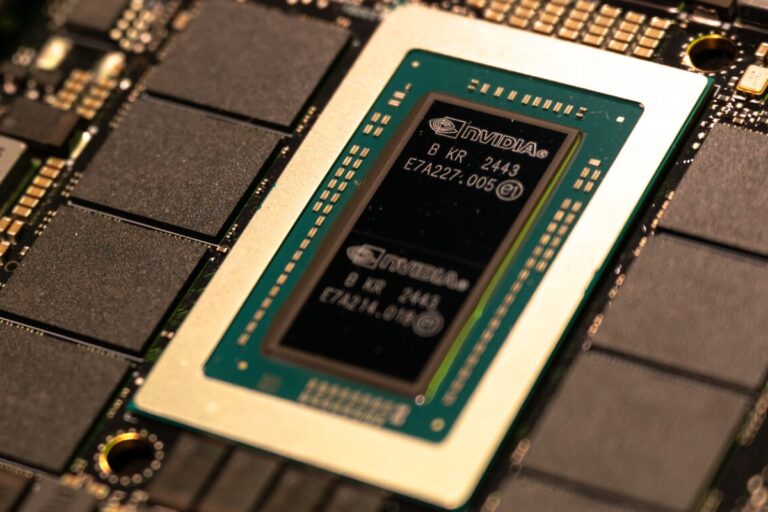

2025 saw a significant surge in AI-related investments, with trillions of dollars invested throughout the year, but some of these deals appeared oddly “circular” to experts. One remarkable investment included Nvidia investing $100 billion into OpenAI, only for the latter to sign long-term deals amounting to $300 billion to use Oracle cloud services. Oracle then announced that it’s paying Nvidia $40 billion to use its chips.

Many AI companies are now making “circular” deals. These intertwined partnerships have drawn mixed reactions in the financial world. Some analysts warn that this could create an AI bubble similar to the dot-com boom, with valuations inflated by internal spending rather than real demand. Others argue that such deals are natural in a fast-growing tech ecosystem.

OpenAI Is Growing, Fast

Despite burning billions of dollars on research and operations, OpenAI continued to set records in 2025, becoming the largest startup ever. In its latest share sale, OpenAI was valued at a staggering $500 billion, more than tripling its late 2024 valuation of $157 billion. Additionally, the company is reportedly aiming for a record-breaking $1 trillion IPO in 2026.

Sam Altman, the company’s CEO, expects it to generate $20 billion in revenue in 2025, but the company is still likely to lose money for the foreseeable future. In November 2025, OpenAI had already signed $1.4 trillion in infrastructure deals, raising concerns about how it will pay for these commitments.

Paying Billions for Talent

In June 2025, Meta announced a $14 billion investment in Scale AI, one of the fastest-growing AI startups at the time. The deal soon raised eyebrows when it was disclosed that Scale AI founder and then-CEO Alexander Wang would join Meta, becoming the company’s “Chief AI Officer.” A few of Scale AI’s top talent left with Wang to join Meta, sparking speculation.

Reports indicate that Meta’s founder and CEO, Mark Zuckerberg, is personally involved in the company’s AI hiring efforts, offering pay packages of up to $100 million to attract top talent from Google, OpenAI, and other competitors. These actions highlight the fierce competition in the current AI race, where talent is a key factor.