2025 Year in Review: Automitive Tech

The automotive industry in 2025 found itself shaped less by innovation on the showroom floor and more by forces beyond it: geopolitics, global competition, and shifting business models. Cars may be more connected and electric than ever, but the industry’s stability increasingly depends on chips, trade policy, and corporate strategy, all of them increasingly chaotic.

From renewed semiconductor disruptions and the rapid rise of Chinese automakers, to growing debates around what it truly means to “own” a vehicle, the past year exposed how deeply the automotive sector is tied to global technology ecosystems. These pressures are redefining not only who leads the market, but also how value is created and captured in modern vehicles.

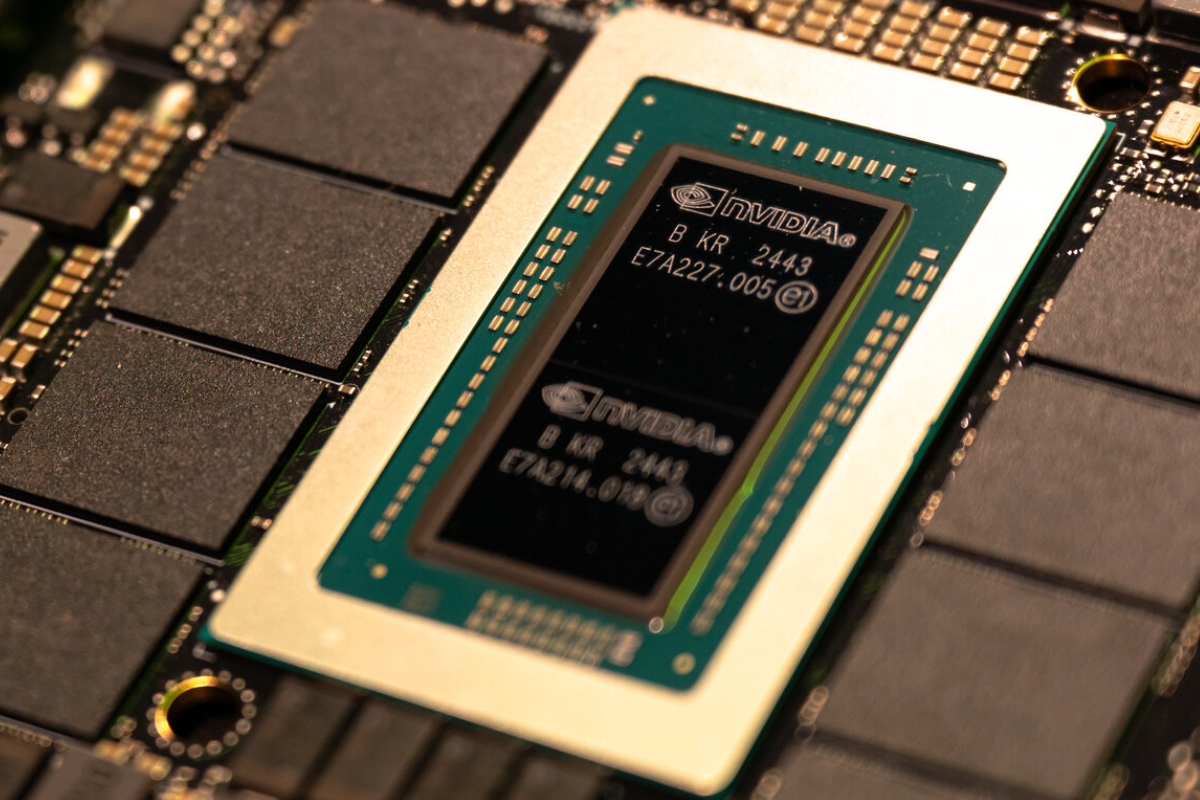

Another Chip Shortage

In 2025, the automotive industry once again faced a chip shortage, but not due to supply chains. Nexperia, a key supplier of semiconductors, is a Dutch company with Chinese owners. Citing national security reasons, the Dutch government assumed control of Nexperia in 2025, prompting the Chinese government to respond by banning the company from exporting its chips.

Due to its market dominance, the ban on Nexperia threatened the global automotive industry, with production quotas being cut and entire assembly lines on the verge of shutting down. Governments quickly took action, and negotiations soon yielded a partial solution that allowed exports to resume, averting disaster. However, issues are not fully resolved and could flare up again.

Chinese Automakers Gaining Ground

In November, Tesla’s board awarded the company’s CEO, Elon Musk, the largest compensation package in history, valued at over $1 trillion, contingent upon his achieving all the goals. The company’s market capitalization remained above $1 trillion for most of the year as well. However, sales numbers have a different story to tell.

Deliveries of the company’s EVs experienced their first decline in 2024, followed by further decreases in most of the first half of 2025. The company’s market share is shrinking in Europe, China, and its home market of the U.S. The company that made EVs “cool” is now losing ground to the aggressively expanding Chinese brands.

The Ownership Model Is Shifting

When you pay for a car, it is a fair assessment that you own that car and all its components. Yet, manufacturers are increasingly nudging toward a new ownership model where you are supposed to pay a subscription to access the full abilities of your car. This trend has been ongoing for a few years now, with occasional customer pushback, but it is now accelerating.

Over the past year, several companies have introduced “special modes” as on subscriptions that supposedly enhance the vehicle. In actuality, many of these modes merely unlock features that were always available in the hardware. Examples of currently paywalled features include heated seats, adaptive headlights, faster acceleration, and higher horsepower.